Are Wall Street Analysts Predicting Dell Technologies Stock Will Climb or Sink?

/Dell%20Technologies%20by%20Poetra_RH%20via%20Shutterstock.jpg)

With a market cap of $88.4 billion, Dell Technologies Inc. (DELL) is a leading global provider of comprehensive information technology solutions, products, and services. The company operates through two main segments: Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG), serving a wide range of customers from consumers to large enterprises worldwide.

Shares of the Round Rock, Texas-based company have outpaced the broader market over the past 52 weeks. DELL stock has returned 27.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 18.4%. Moreover, shares of Dell Technologies have gained over 13% on a YTD basis, compared to SPX's 7.6% rise.

Looking closer, the computer and technology services provider stock has slightly lagged behind the Technology Select Sector SPDR Fund's (XLK) increase of 28.1% over the past 52 weeks.

Despite reporting better-than-expected Q1 2026 revenue of $23.4 billion on May 29, Dell's shares fell 2.1% the next day due to its adjusted EPS of $1.55 missing Wall Street estimates. Additionally, while Dell raised its annual adjusted EPS forecast to $9.40 and posted $12.1 billion in AI server orders with a $14.4 billion backlog, slower PC refresh cycles and intense competition in AI server production signaled potential headwinds.

For the fiscal year ending in January 2026, analysts expect DELL's EPS to grow 14.4% year-over-year to $8.56. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

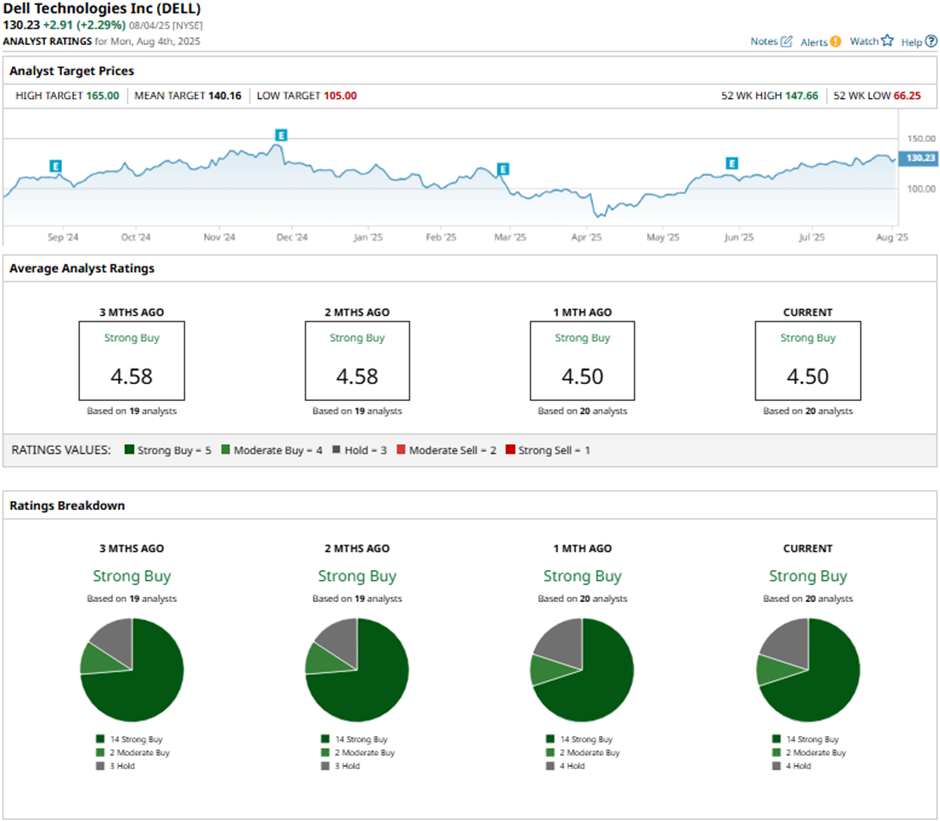

Among the 20 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 14 “Strong Buys,” two “Moderate Buy” ratings, and four “Holds.”

On Jul. 17, JPMorgan analyst Samik Chatterjee raised Dell Technologies' price target to $145 and maintained an “Overweight” rating, citing expected upside from robust cloud spending in the second half of 2025.

As of writing, the stock is trading below the mean price target of $140.16. The Street-high price target of $165 implies a potential upside of 26.7% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.